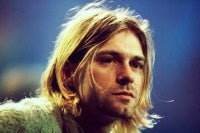

'We have more reserves now, yet told we may go bankrupt if Ringgit pegged?' - Mahathir

MINDERJEET KAUR19 May 2022 05:00pm

Tun Dr Mahathir Mohamad further ask Bank Negara for possible solutions as Ringgit slides further.

SHAH ALAM - Tun Dr Mahathir Mohamad today spoke on the success of pegging the Ringgit in the late 90's despite facing a worsening financial situation than now.

"Our reserves than were not as big as now. Still, we overcame the financial and economic problems caused by the depreciation of the Ringgit through pegging the Ringgit at RM3.80 per USD," said the former prime minister in a statement today.

This comes as the Ringgit has been depreciating swiftly against the US dollar over the past few weeks. On May 13, Bank Negara Malaysia (BNM) governor Nor Shamsiah Mohd Yunus dismissed suggestions to peg the ringgit to the US dollar, saying it will not be in Malaysia’s best interest.

She said such a move comes with substantial risks and trade-offs.

“A flexible exchange rate buffers the economy from adverse effects from economic shocks and preserves Malaysia’s competitiveness under challenging global conditions,” she had told the media.

"The fact remains that the pegging was successful.

"The International Monetary Fund (IMF) and World Bank admitted that Malaysia did the right thing and helped other countries to overcome the serious devaluation of their currencies also. We were even able to deal with CLOB, the stock market set up by Singapore," he added.

"I am just curious. We have more savings and reserves now compared to 1997- 8. Yet I am told that if we peg, we may go bankrupt?," Mahathir further said.

The prime minister for 22 years said when the Ringgit was pegged it would not cause the outflow of foreign investments in Malaysia. "From the little that I know about finance, outflows of foreign investment is due to the expectation of further depreciation of the Ringgit or shares.

"When the Ringgit was pegged there would not be further depreciation against the USD. Assured of the value of their investments, the need to divest was removed," he explained.

Citing an example, Mahathir said: "Let’s say an investor invested USD$1 million at the time when the Ringgit was stronger, say RM3.80 per 1USD. Effectively his investment would be worth RM3.8 million in Malaysia. This value would be sustained when the Ringgit is pegged."

But if the Ringgit depreciates to RM4.5 to USD$1, the investor would get only USD$844,000 USD from his USD$1 million investment should he divest, losing USD$156,000 immediately.

On the other hand, if the Ringgit is pegged at RM3.80, he said the cost of import would be only RM3.8 million per USD$1 million. "A pegged Ringgit would save RM700,000 in the cost of import," he added.

Mahathir further told Bank Negara that in 1998 the Central Bank had less reserves.

"We did not know whether the reserves were held in cash, and if in cash, in what currency. Still, we were able to change Ringgit into USD so as to pay in USD.

"Now the Central Bank has more reserves in USD, I believe. earnings in USD should be deposited with the Central Bank, in exchange for Ringgit. There should be no shortage of USD when needed," he added.

However, now he said there are no suggestions for Bank Negara on any possible solutions.

The ringgit today slid further to open lower at RM4.4 against the US dollar, the lowest since March 2020 following a hawkish stance by the US Federal Reserve (Fed) to tighten its monetary policy.

Download Sinar Daily application.Click Here!