84 per cent of M’sians don’t have monthly savings - Research

SUNGAI BULOH - A total of 84 per cent of Malaysians do not have a dedicated monthly savings based on Financial Education Network’s (Fen) research.

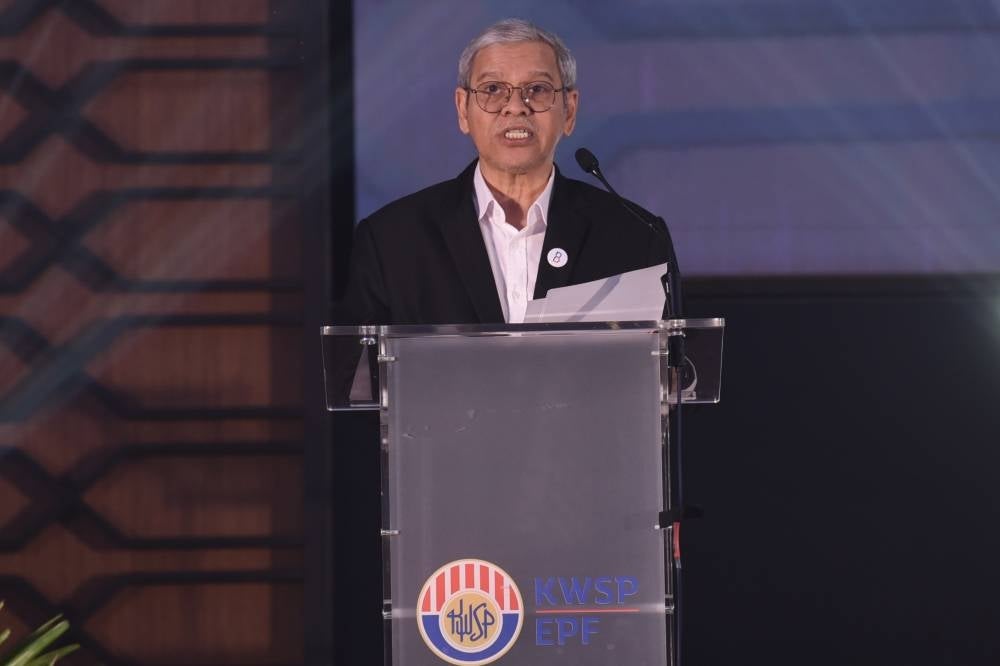

Employees’ Provident Fund (EPF) chairman Tan Sri Ahmad Badri Mohd Zahir said most Malaysians would have short-term savings that would ultimately be used at the end of the month to maintain expenditures.

“The data showed 52 per cent felt that it was difficult to set aside RM1,000 for emergency usage.

“76 per cent of Malaysians have a budget, but not all of them would adhere to the budget,” he said in his speech at the 2022/2023 Belanjawanku Application Launching Ceremony at the EPF Tower on Tuesday.

EPF was a member of Fen which conducted the study through data from the National Financial Literacy Strategy 2019 to 2023.

Commenting on the Belanjawanku initiative, Badri said the application developed in collaboration with Universiti Malaya Social Welfare Research Centre (SWRC) provides a minimum monthly expenditure estimate for various types of goods and services according to household rates.

He described the initiative as able to aid the people in financial planning and more modest spending.

“As a pilot project, this guide was developed in 2019 for users in Klang Valley.

“The Belanjawanku guide has now been expanded to be used by users in 11 main areas throughout the country such as Johor Bahru, Alor Setar and Kuching.

“As of May, the Belanjawanku application recorded 12,000 downloads,” he said.

SWRC director Professor Datuk Dr Norma Mansor said the low level of financial literacy and the increase in the cost of living were factors in Malaysians having low savings in addition to high debt and high bankruptcy among youth.

“The Belanjawanku application plays the role of a guide for financial planning and individual debt management in addition to recommending the amount of savings for future use.

“Policymakers can also use Belanjawanku as a benchmark in dealing with the issues of cost of living, purchasing power parity and eradicating poverty,” she said.

Download Sinar Daily application.Click Here!