What a budget: Of the enigmatic cut on Devex and bracing for a tough 2024

SHAH ALAM – For weeks, the narrative of next year’s fiscal blueprint centred on it being a strong catalyst for economic growth, yet, today, an intriguing plot twist took centre stage as the Unity Government’s second supply bill was tabled.

There was a conspicuous drop in development expenditure (Devex) for the impending year.

In the revised Budget 2023, the Government allotted RM99 billion for Devex but in Budget 2024, the allocation shrunk by nearly 10 per cent – specifically at RM90 billion.

This is a cause for concern because a reduction in development expenditure would be indicative of the government’s shifting priorities from capital investment, restructure development and economic growth initiatives.

How odd.

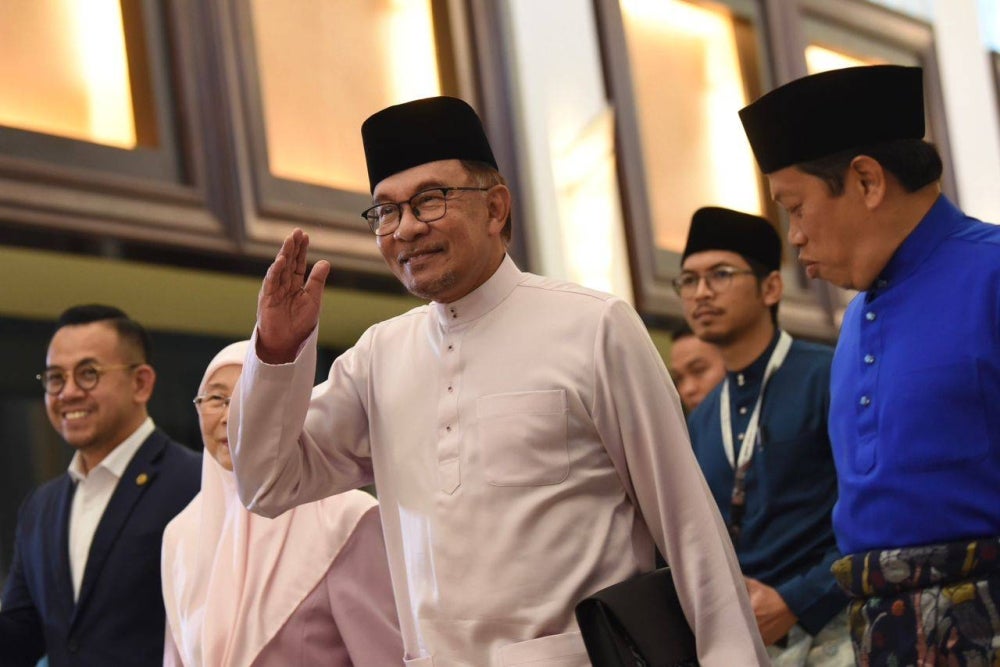

Even more so when Prime Minister Datuk Seri Anwar Ibrahim remarked that the supply bill was a continuation of the expansionary nature of the revised Budget 2023 which he unveiled in February 2023.

Naturally, operating expenditure (Opex) still ate a huge chunk of the supply bill; where the allocation for it saw an increase of 5.08 per cent for Budget 2024, specifically RM303.8 billion, compared to Budget 2023’s RM289.1 billion.

Now, this was hardly surprising as Malaysia’s Opex has never been recorded to have shrunk, primarily due to the ballooning size of the civil service.

Speaking of the said sector, the civil servants will be very pleased with the early incentive payments of RM2,000 to those Grade 56 and below.

On the outset, this seemed a good move in building rapport with the civil servants, but the thing is, there are some in Grade 54 and 56 who are paid a salary of RM15,000 a month.

Perhaps, the government should fine tune the disbursement of this incentive. Make it more targeted, give it those who earn below than RM5,000 or to government officers from the B40 and M40 income groups.

Nonetheless, credit is due when it’s due.

Plenty of goodies, especially in the form of matching grants, were announced in Budget 2024.

And to a certain extent, Anwar was also walking the talk on his mission to find ways to curtail the “maha kaya” (mega rich) from unscrupulously exploiting the system to enrichen their coffers.

If Budget 2024 was to be passed in Parliament, there will be a 10 per cent capital gains tax for the sale of shares that are not listed on the stock exchange.

In simpler terms, if a company makes money from selling shares that are not publicly traded, they will owe the government 10 per cent of that profit in taxes.

Be that as it may, the signs are rather obvious that Malaysians will have to brave another tough year.

The cost of living, particularly, will likely be higher.

The culprits?

Well, for starters, the Sales and Services Tax (SST) will be upped from 6 to 8 per cent and while Anwar stressed that food, beverages, and telecommunications will be exempted; logistics aren’t.

Unfortunately, logistics are usually the means in which some foods and beverages are transported.

And in the peculiar world of the Malaysian economy, manufacturers will always – somehow – find ways to dump the resulting incremental cost to the consumers.

On top of that, the government still intends to do away with ceiling price of eggs and chicken because the situation has improved and therefore no longer required government subsidy.

Anwar argued that this would allow the local market to function freely to ensure a steady supply of chicken and eggs.

So, basically, it’s back to demand-and-supply...but what if those in charge of the supply artificially induce a shortage in order to jack up prices.

You know, like how the authorities discovered the existence of rice millers hoarding local white rice which resulted in a nationwide shortage where hardly any bags of ‘Super Spesial Tempatan’ rice were sold in shops and hypermarkets.

But of course, the cherry on top was the increment of excise duty on sugary beverages from 40 sen to 50 sen per litre.

And although, excise duty will be imposed onto the manufacturer, there are hardly any guarantee that this cost will also be passed to the consumer and if this happens; one’s favourite can of fizzy drinks will be more expensive in 2024.

Gosh.

Well, if there's any silver lining, at least those who watched yesterday’s presentation of Budget 2024 had the opportunity to expand their knowledge of the Malay language.

We've learned when to use archaic words like "arakian," "marcapada," "mahsul," and "walhasil."

Download Sinar Daily application.Click Here!