The hidden cost of travelling unprepared

Overseas emergencies demand insurance, not public donations

NUR ADNIN MAHALIM

FINANCIAL preparedness is a fundamental responsibility for consumers travelling overseas and travel insurance plays a critical role in safeguarding individuals and their families from devastating financial consequences when emergencies strike.

According to the Federation of Malaysian Consumers Associations (Fomca), the growing reliance on crowdfunding to pay for overseas medical emergencies is not only risky but also reflects a failure in basic travel planning. While public donations may offer temporary relief, they cannot replace protection that should be arranged before departure.

Fomca vice-president and legal adviser Indrani Thuraisingham said that although crowdfunding demonstrates public compassion, it should never be treated as a substitute for responsible consumer behaviour.

“From our perspective, travel insurance is part of responsible consumer conduct. Crowdfunding, while reflecting goodwill and generosity, offers only hope and uncertainty after a crisis has already occurred,” she said.

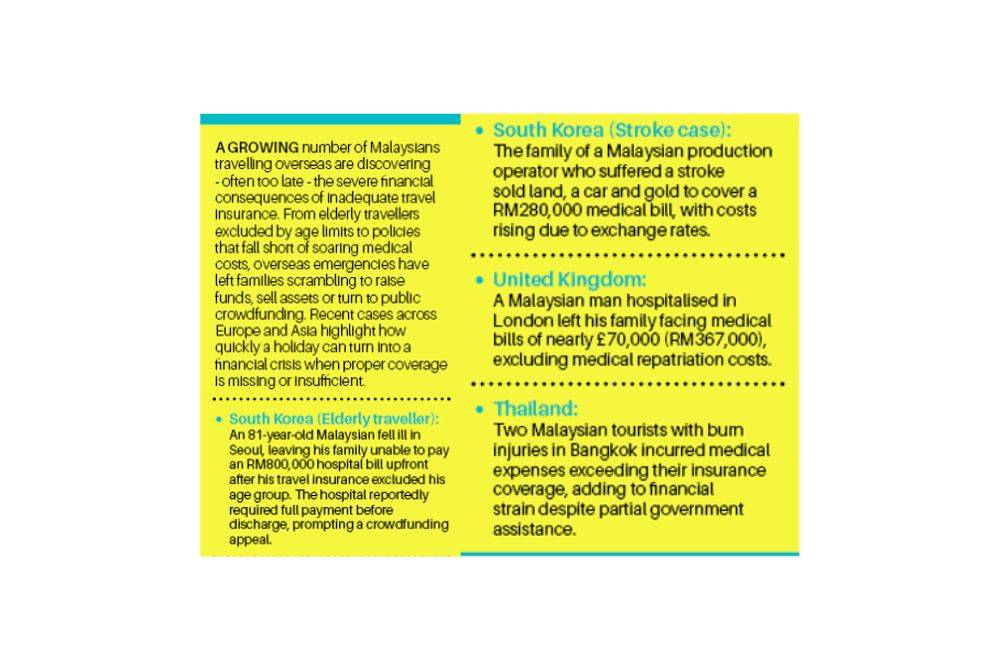

She explained that travel insurance provides certainty, immediacy and legal protection, whereas crowdfunding has no guarantee of success and often comes too late. Overseas medical treatment can easily run into tens or even hundreds of thousands of ringgit, and many hospitals require a guarantee of payment before treatment can begin.

“When Malaysians travel abroad without insurance, they expose themselves and their families to severe financial risk. Crowdfunding is uncertain, takes time to raise funds, depends entirely on public sympathy and carries no legal obligation for payment,” Indrani said.

In contrast, travel insurance offers immediate financial backing through cashless hospital admission, emergency medical treatment, evacuation and repatriation, as well as coverage for trip cancellations, delays and lost baggage.

“Relying on crowdfunding after an accident is like trying to buy fire insurance after your house has already burned down,” she added.

Fomca stressed that travel insurance is not a luxury but a basic form of consumer protection when travelling overseas. From the association’s standpoint, it protects consumers in three critical ways: coverage for medical costs, protection against travel-related losses, and legal and contractual safeguards.

Overseas medical expenses can be financially devastating. Emergency hospitalisation may exceed RM200,000, surgery can cost more than RM100,000, air ambulance evacuation can reach RM250,000 and medical repatriation may cost up to RM150,000.

Without insurance, hospitals may refuse treatment without a deposit, families are forced to scramble for funds, treatment may be delayed, and patients may even be discharged early due to an inability to pay. With travel insurance, insurers issue guarantees of payment, hospitals can provide immediate care, and families are spared the emotional and financial distress of appealing for public donations during a crisis.

Travel insurance also covers flight cancellations and delays, missed connections, additional accommodation costs, lost or stolen luggage, emergency passport replacement and even travel agency insolvency. Crowdfunding, on the other hand, does not cover missed tours, non-refundable bookings, replacement flights, emergency accommodation or daily living expenses overseas.

Equally important is the issue of legal protection. Travel insurance is a legally binding contract regulated by Bank Negara Malaysia and governed by contract law. Consumers have the right to make claims, dispute decisions and seek redress through established regulatory channels.

Crowdfunding offers no such safeguards. There is no legal obligation on donors, no enforcement mechanism, no guaranteed outcome and no consumer protection framework.

Fomca warned that skipping travel insurance to save a few ringgit a day can ultimately cost families their life savings. A typical travel insurance policy costs between RM20 and RM50 for short trips, and RM80 to RM150 for longer journeys, and is often included with credit cards or travel packages.

Yet a single overseas accident can wipe out Employees Provident Fund savings, education funds, retirement plans and family assets.

Fomca chief executive officer Dr Saravanan Thambirajah echoed these concerns, stressing that insurance offers far stronger and more reliable protection than relying on crowdfunding after an incident.

“Travel insurance ensures preparedness before risk materialises, while crowdfunding is reactive and uncertain.

“Overseas medical emergencies require immediate access to treatment, which insurance facilitates without upfront payment,” he said.

He added that insurance provides certainty of coverage, while crowdfunding offers no assurance of raising sufficient funds, particularly when overseas medical bills can reach hundreds of thousands of ringgit.

“Without insurance, travellers may return home burdened with debt, unpaid hospital bills or ongoing medical costs that affect their entire family,” he said.

Saravanan also cautioned that relying on crowdfunding shifts personal responsibility onto the public.

“While public generosity reflects compassion, it should not replace basic financial planning. Travelling without insurance and later appealing for donations places an avoidable burden on society, especially when travel insurance can cost as little as a few ringgit a day,” he said.

Just like passports and visas, Fomca said travel insurance should be regarded as an essential part of travel planning to protect travellers’ dignity, health and financial security.

“Compassion from the public should never replace responsibility by the traveller. Travel insurance should be the plan. Crowdfunding should never be the emergency strategy,” Saravanan said.

Download Sinar Daily application.Click Here!