Travel insurance beats crowdfunding abroad

A medical emergency overseas shouldn’t depend on public goodwill. Travel insurance and financial readiness protect both health and the wallet.

NUR ADNIN MAHALIM

TRAVELLING abroad is thrilling, but even the most carefully planned trips can suddenly become costly. A minor accident, sudden illness, lost luggage or unexpected trip disruption can turn a dream vacation into a financial nightmare.

For some Malaysians, crowdfunding through social media has become a way to cover medical emergencies, evacuation costs or repatriation. While such appeals reflect public goodwill, experts warned that relying on generosity is no substitute for proper travel insurance or takaful.

Malaysian Takaful Association Chief Executive Officer Mohd Radzuan Mohamed said many travellers still underestimate the risks of going overseas.

“A common mindset is ‘tidak apa’, it will never happen to me, especially among younger and frequent travellers,” he said, adding that viewing travel protection as optional rather than essential can leave travellers exposed to sudden, high costs.

There is also a misconception that insurance is expensive. In reality, coverage for short trips within Southeast Asia can start from as little as RM27, depending on age, destination, plan type and trip duration. Without it, medical bills, emergency evacuations or trip disruptions can quickly spiral into expenses that far outweigh the cost of a modest insurance plan.

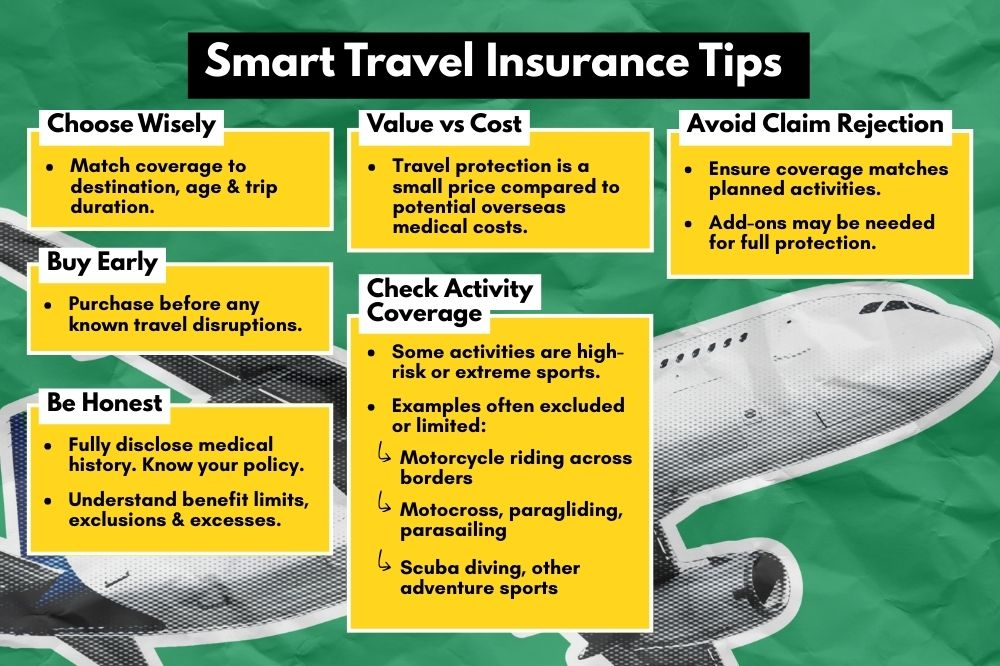

However, Radzuan emphasised that choosing the right plan requires a proactive approach.

“Review policy details carefully, including benefit limits, exclusions and claim procedures. Understanding aspects such as pre-existing condition exclusions, excess amounts and whether expenses are paid upfront or reimbursed ensures travellers get coverage that truly meets their needs,” he said.

Comprehensive travel takaful plans offer broad protection. Coverage can include overseas medical and hospitalisation, emergency evacuation and repatriation, trip cancellation or disruption benefits, baggage and travel document protection, personal accident benefits and optional add-ons such as Covid-19 or adventure activity coverage. Contributions vary according to age, destination, trip duration and plan type.

Despite the advantages, some travellers still prioritise cost savings over protection, particularly for short or leisure trips. This mindset is sometimes reinforced by crowdfunding, which may create the false impression that public donations can replace insurance.

“Crowdfunding reflects strong community spirit, but it does not guarantee timely or sufficient funds for urgent medical treatment, evacuation or repatriation,” Radzuan warned.

Furthermore, medical costs overseas can escalate rapidly. Delays in securing funds may directly affect access to immediate care, risks already covered under comprehensive travel plans at a relatively low daily cost. Non-disclosure of pre-existing conditions or inadequate coverage can also result in rejected claims, leaving families financially exposed.

And, some countries now require proof of travel protection for visa or entry, particularly for destinations with high medical costs or health risks. While travel insurance is not mandatory everywhere, it remains a responsible and essential precaution.

“Travel protection should be seen as a primary safeguard, not a backup plan to crowdfunding. Mandatory coverage for high-risk destinations could protect travellers from significant financial hardship while ensuring they receive timely, appropriate care when they need it most,” Radzuan said.

He noted that awareness of travel insurance is improving as it becomes more accessible and as information spreads online. Travellers are increasingly recognising key benefits such as overseas medical coverage, emergency evacuation, and safeguards against trip cancellations or disruptions.

However, frequent traveller Khairul Idzwan Kamarudzaman believed the reluctance to buy travel insurance is largely due to unfamiliarity and low awareness.

“Many travellers skip travel insurance mostly because they lack exposure on how to buy it or make a claim if there’s an issue. It’s not yet a culture among Malaysian travellers,” he said.

Travellers who have journeyed safely in the past may also feel insurance is unnecessary.

“Not all travellers are fully aware because sometimes the terms and conditions are so lengthy that people skip reading them altogether. It’s important to read the policy so they know what is covered and what is not, especially for those buying insurance on their own without an agent.

“Accidents do happen. Crowdfunding to cover medical costs or emergencies is open to abuse by scammers, and sometimes it takes time to collect the needed amount. That’s why having insurance is essential,” he added.

Although Khairul does not have personal experience with travel mishaps, he has observed online discussions highlighting the issue. Instead of making insurance mandatory, he advocated for education and exposure.

“More personal experiences and online videos should be shared to show the difficulties travellers face if they decide not to take insurance. This can encourage more people to get coverage voluntarily,” he said.

He further stressed that travel insurance is not just a formality. It is a safeguard that every traveller should consider seriously, even if the journey seems routine.

“Crowdfunding or public appeals may provide temporary relief, but they cannot match the certainty, speed, or reliability of a proper insurance plan. Financial preparedness, not goodwill, should always be the first step before boarding a plane,” he advised.

Download Sinar Daily application.Click Here!