Illicit cigarettes still dominate local market after almost a decade

SYDI ALIF

KUALA LUMPUR - Illicit cigarettes still dominate Malaysia's market after almost a decade of efforts to eradicate them.

Japan Tobacco International (JTI) Malaysia general manager Khoo Bee Leng stressed that more than 50 per cent of the market remains illegal despite its decline which was not even a whole single per cent, at a press conference held at Aloft Kuala Lumpur Sentral on Feb 15.

The decline first took place in 2021 at 57.30 per cent from 63.80 per cent in 2020. Later in 2022, the number kept going down, but only as little as 0.7 per cent lower at 56.6 per cent.

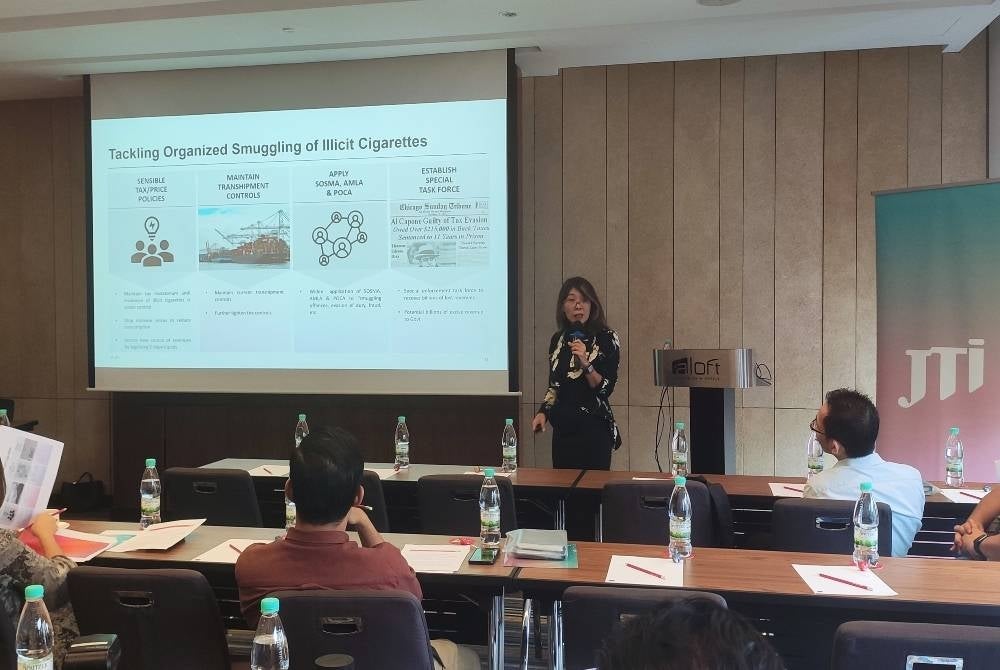

The reduction from 2022 to 2021 was associated with the previous government's move to limit cigarette transshipment to designated ports under Budget 2021.

Before the reduction, the statistics experienced a constant increase since 2015 when the government raised the excise tax on cigarettes by a whopping 43 per cent, specifically from RM280 million to RM400 million per 1000 sticks.

Notably, it was the last year that illicit cigarette trades were below 50 per cent at only 36.90 per cent before it shot up exponentially to 52.30 per cent in 2016.

While the tax increase aimed to reduce total cigarette consumption, it had rather significantly caused a shift of consumption from legal to illicit products. While the total consumption only went down by three per cent, the legal consumption had declined alarmingly by 33 percent since the tax raise.

On top of that dramatic move which was dubbed "counterproductive" by JTI, the deterioration was also driven by the growing options of cheaper substitutes including e-vapes (disposable and non-disposable) and heated tobacco product which are sold at a fraction of the legal price.

Under the Control of Tobacco Products Regulations (CTPR) 2004, no cigarette can be sold below the legal minimum retail price of RM12.00 per pack.

To explain the failure of excise tax increase in boosting revenue, JTI brought up an economic theory called the Laffer Curve. It suggests that once a tax reached a certain threshold, its revenue would only go downhill.

Instead, what is urged by JTI is optimising revenue collection through e-vape, by which Malaysia could have amassed RM866 million in 2022.

"E-vape is a very good opportunity for the government to increase revenue.

"The minister of finance already said, "I want to tax." So it's almost RM1 billion there already waiting to be collected." Unfortunately until today, the electronic cigarette has still yet to be regulated by the health ministry leaving no control at all on its production nor commercialisation.

When asked on the reason the government held back from the regulation, Khoo revealed that the previous health ministry tried to regulate e-vape through a new tobacco bill and the controversial Generational End Game (GEG), but it was not passed in the House of Representatives.

However, the general manager noted that the regulation can be achieved by amending the CTPR.

Download Sinar Daily application.Click Here!