China, India 'two exceptions' to global slowdown in 2023, says World Bank chief

11 Apr 2023 03:13pm

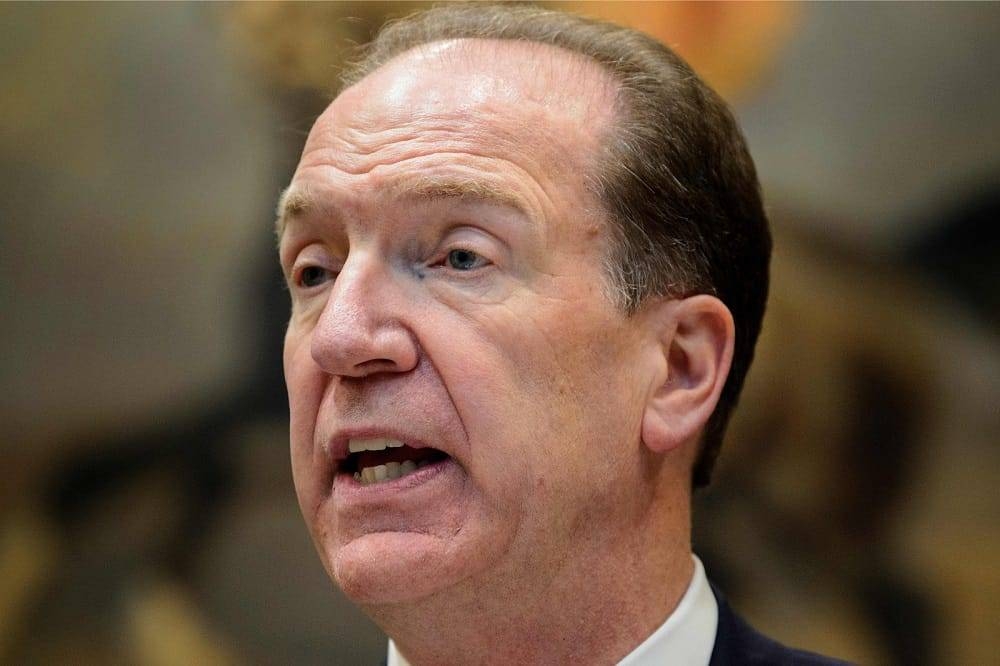

World Bank Group President David Malpass

A

A

A

Malpass made the remarks in a media call ahead of the International Monetary Fund and World Bank Spring Meetings week, according to a press release posted at the worldbank.org on Monday.

"Global growth is expected to be weak this year, slowing to 2 per cent from 3.1 per cent in 2022. For the US, we're expecting a slowdown to 1.2 per cent from 2.1 per cent in 2022," said Malpass.

"Several factors are weighing on the second half outlook: Oil prices have jumped back above US$80 dollars a barrel. The recent banking sector stress dampens activity. And inflation pressures persist. The US month-over-month core inflation has been rising over the last five months," he said.

"I'll note two exceptions to the slowdown: China and India. China's GDP growth is rebounding to over 5 per cent in 2023, with strong private investment," said Malpass.

"I note the stability of China's currency and the countercyclical nature of its monetary policy," he said.

"India continues to be one of the fastest-growing major economies in the world. We're looking for growth of 6.3 per cent in their FY23/24," said Malpass.

Malpass noted that, looking to the big picture, the global economy faces two problems.

"First, the normalisation of interest rates after an artificial decade near zero. This creates problems in terms of the duration mismatch as we've seen in the bank failures, liquidity shortages, and how to allocate the losses.

"The duration mismatch will take time to digest. With inflation persistent and the dollar weakening, the risk is that the losses will be allocated to those with lower incomes, including through inflation," he said.

A second major problem is that the available global capital is being absorbed by a narrow group of advanced economies that have extremely high government debt levels, said Malpass.

"I'll call them 'sinkholes.' To make matters worse, their populations are aging rapidly and the peace dividend of the 1990s was used up," he said.

"I've advocated a range of new policies that would spur production to combat inflation and currency weakness, but the likelihood is a long period of slow growth, asset repricing, and capital moving in the wrong direction - toward a narrow group of governments and big corporations rather than to the small businesses and working capital that could add to global growth," said the World Bank chief. -Bernama/Xinhua