Takaful registers stronger business growth in 2022, wider services, products

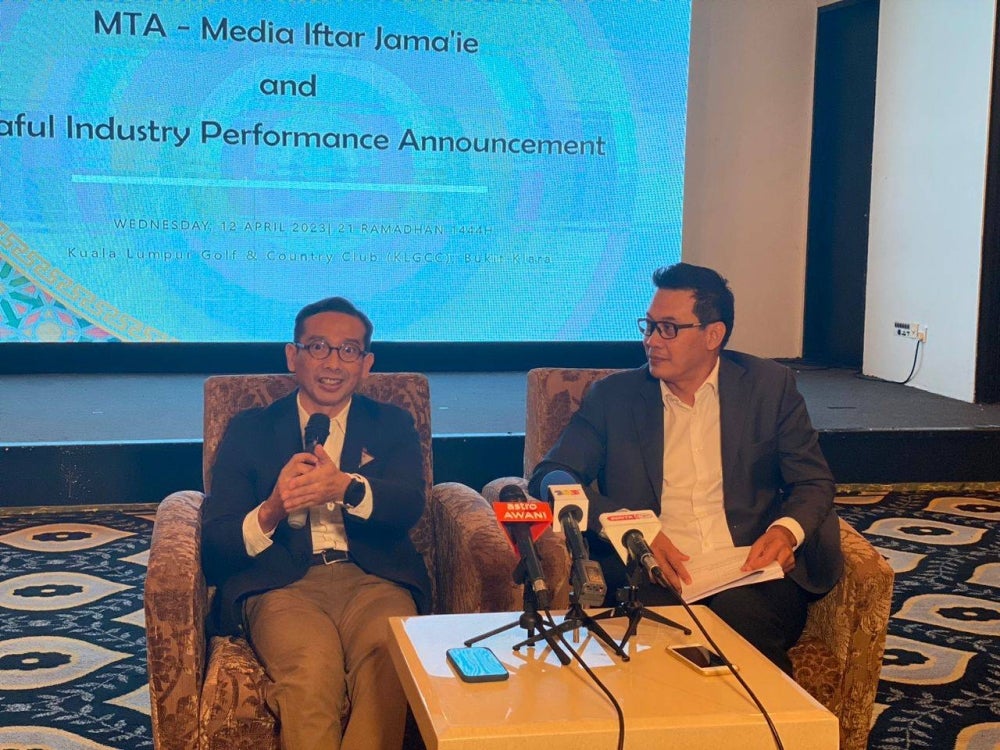

(From left) MTA chairman Elmie Aman Najas and MTA CEO Mohd Radzuan Mohamed during Q&A session at MTA Media Iftar Jama’ie and Takaful Industry Performance Announcement in Kuala Lumpur Golf Country Club today.

A

A

A

The growth was attributed to growing popularity of takaful products, the introduction of new innovative products and the adoption of digital technologies to enhance service delivery.

The Family Takaful achieved a penetration rate of 20.1 per cent in 2022 as compared to 18.6 per cent in the previous year based on the number of certificates issued against the total Malaysian population.

MTA chairman Elmie Aman Najas said the number of certificates issued for 2022 has increased to 6.63 million certificates, compared to 6.07 million in 2021.

Overall, the Family Takaful new business industry registered RM10.06 billion in gross contributions, an increase of 18.3 per cent compared to RM8.5 billion in 2021.

In parallel, a total of 1.31 million new business certificates were issued in 2022, a 15.6 per cent increase from the 1.14 million certificates in 2021.

Meanwhile, gross contribution of total business in force was RM 8.34 billion in 2022 in contrast to RM7.42 billion in 2021.

Agency and Bancatakaful were the main channels for new business total contribution at 22 per cent and 44 per cent respectively.

For new businesses, Agency recorded 72 per cent as the main distribution channel for Annual Contribution Takaful plans.

Meanwhile, Bancatakaful was the main contributor for Single Contribution Takaful plans with 49 per cent.

“In relation to agency business, the pandemic has had a significant impact on the growth rate of new agent recruitment,” Elmie said.

Other industry sectors similarly showed encouraging growth in which the General Takaful business registered Gross Direct Contributions of RM4.64 billion, with Motor Takaful business contributing RM3.07 billion, and the Fire Takaful business with RM0.84 billion in 2022.

These are increases of 21.1 per cent, 20.7 per cent and 23.5 percent respectively from their performances in 2021.

Motor Takaful remained at the top position in terms of portfolio mix of General Takaful at 66.2 per cent, followed by Fire Takaful at 18.2 per cent.

For 2022, the Takaful industry paid out a total of RM7.02 billion in net claims, an increase of 25.9 per cent from the previous year, RM5.58 billion.

Out of this, Family Takaful recorded total net claims payout of RM5.53 billion which has a spike in growth of 23.09 per cent from the year 2021, RM4.50 billion.

Meanwhile, General Takaful recorded a total net claims payout amounting of RM1.49 billion, an increase of 38 per cent from the previous year, RM1.08 billion.

This demonstrated the industry's commitment to providing financial protection to its customers and the community as well as emphasises its contribution in supporting the economy.