Long global recession with 'very serious' problems ahead, says veteran US investor Jim Rogers

12 Jul 2022 05:50pm

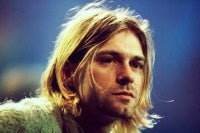

Veteran US investor Jim Rogers says recession may have already arrived considering the soaring inflation and high-interest rates.Pic sourced from marketwatch

WASHINGTON -The global economy will go into a long recession in the coming years and face very serious issues about which everyone should be concerned, veteran US investor Jim Rogers told Sputnik.

"We will have very serious problems in most of the world, you should be worried," Rogers said, adding that it will last between two and four years.

He believes the recession may have already arrived considering the soaring inflation and high-interest rates.

Concerns over a recession intensified across the US after the Federal Reserve Bank of Atlanta forecasted a 1% contraction in GDP for the second quarter. The US Commerce Department reported a 1.6% decrease in GDP for the first quarter. An economy is considered to be in a recession if there are two straight quarters of GDP decline.

A cluster of economic data of late has also suggested that the US may well be headed for a recession.

A closely-followed barometer of the US services sector hit 20-month lows last month.

There was also the highest number of job cuts in 16 months in June, a private-sector employment tracker said in monthly data on Thursday, an indication that the red-hot US labour market may be cooling. That came after the Labour Department reported a day earlier that job openings declined to 11.25 million in May from 11.68 million in April.

US inflation has been persistently running at four-decade highs since late last year, with the closely-watched Consumer Price Index growing at an annualised rate of 8.6% as of May.

The Federal Reserve's target for inflation is 2% per year and the US central bank has vowed to raise interest rates as much as necessary to achieve the target. However, economists cautioned that the Federal Reserve's aggressive interest rate hikes will land the US into a deep recession.

On the dollar, Rogers remarked that the greenback is "coming to an end as the top currency," but it's not going to happen right away but recent actions by the US, including confiscating other countries' dollars, will accelerate the move away from the dollar.

"They think the dollar is a safe haven. It's not, because we are the largest debtor nation in world history. But no international currency has lasted more than 100 or 150 years," he noted.

This year's rally in the dollar - which is up 9% against a basket of six major currencies - has strengthened its standing as the world's reserve currency, helping the Federal Reserve somewhat in its aim to fight the worst US inflation in 40 years.

Many countries like Russia, China, India, Brazil and Iran are looking for something to compete with the dollar. The Chinese yuan cannot become the world's international medium of exchange if it cannot be bought and sold," he explained.

Commenting on cryptocurrency prospects, Rogers said that all money is going to be in the computer someday.

"It already is in China. In China, you can't take a taxi using money, you have to have your crypto," he said.

"They are ahead of the rest of us, all working on crypto money, governments want it very much because it makes it easy for them and then they know everything you do. But when that happens, when the US for instance says okay, this is now the new money, they're not going to say but if you want to use somebody else's money you can, governments like monopoly and control."

"Cryptocurrency is only just something to trade and buy and sell. If it starts succeeding at becoming money with government money, then governments will do something, they will change the law," he added. "They will regulate it, they will control it. Governments want control. Governments want monopolies." - Bernama

Download Sinar Daily application.Click Here!