Don't make the wrong move when buying auction houses, expert says

Buying an auction house is risky, you need to have knowledge before making a bid

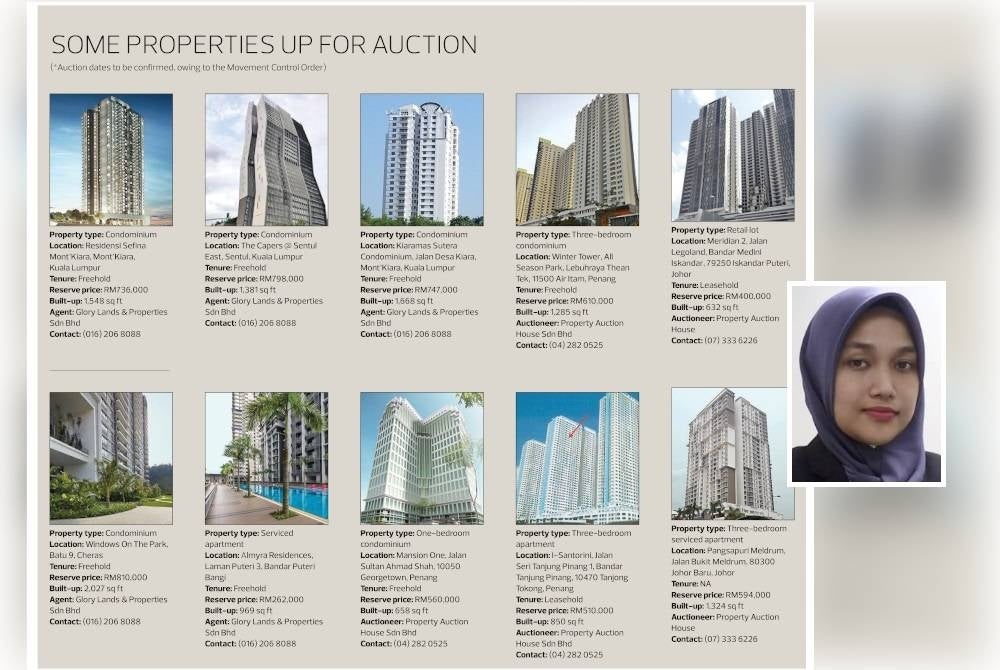

SHAH ALAM - Even though auction houses are cheaper than market price, the public is reminded to be careful when buying one to avoid bigger losses after successfully bidding on the asset.

Real estate lawyer Nurin Nabilah Un said auction house prices were indeed 30 to 50 per cent cheaper than the market, but there were hidden costs that needed to be paid if bidders were not careful.

She said bidders needed to know several things about the condition of the house in addition to having the financial ability before starting the bid.

"There are cases of bidders who suffer huge losses when they have to pay additional costs after successfully bidding on a house.

“Many people think that if they successfully make a bid for a house of RM200,000, then they only have to pay that amount.

"That's a common mistake made by bidders. For that reason, people are advised to do research or get legal advice first," she told Sinar Ahad.

The owner of Nurin Nabilah and Co law firm said that bidders must first look at the house they wanted to bid on by doing a physical inspection to ensure that the cost of repairs was not too high that it exceeded the market price of the house.

"If the price of the auction house is 50 per cent less than the market price, there is likely damage that will cost more to repair.

"In addition, bidders also need to check the house's market price by searching various sources such as online real estate buying and selling platforms or consulting a real estate agent to find out the market price of a house in the area," she said.

She said that as many as 90 per cent of bidders who wanted to buy an auction house did not check the loan eligibility at the bank before bidding.

"When failing to get a loan for a house bid within 90 to 120 days depending on the property type, the deposit issued will be lost.

"If the house costs RM300,000 and the 10 per cent deposit that needs to be paid in advance is RM30,000.

“Instead of buying a cheap house, they continue to lose tens of thousands of ringgit because they failed to get a financial loan from any financial institution," she said.

Nurin said bidders also needed to provide money for legal costs, which is one per cent in addition to the home insurance which is the primary condition for buying a house.

"In addition, high arrears that have to be borne by bidders is also a common occurrence. There may be no problem with electricity, water and Indah Water bills since the buyer only needs to provide a deposit to open a new account.

"However, usually bidders will be surprised by the backlog of maintenance costs that can reach thousands of ringgit.

“In this case, the cost has to be paid by the successful bidder and not the old owner of the house," she explained.

Download Sinar Daily application.Click Here!