Government should reconsider GST – Muda

NILAM NUR ATIKAH OSHMAN

SHAH ALAM – Malaysian United Democratic Alliance (Muda) proposes that the government should reconsider the implementation of the goods and services tax (GST) system to ensure the country's economy remains sustainable and robust.

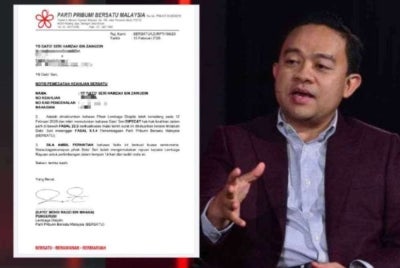

Muda vice president Zaidel Baharuddin said the GST tax system was more comprehensive and transparent compared to sales and service tax (SST).

He said it was a more stable source of income for the government and could reduce the country's dependence on oil and gas tax.

"As we all know, revenues from commodity resources like oil and gas are too dependent on outside factors such as the world's geopolitical situation.

"To ensure this implementation does not burden consumers, especially in terms of the price of goods, the government can consider implementing GST at a lower rate than in the past such as an initial rate of three percent for example," he said in a statement on Tuesday.

Zaidel said the government could use various mechanisms such as the Anti Profiteering Act or the Price Control Scheme to ensure the stability of the price of goods during the migration process of the taxation system apart from imposing a zero per cent rate on basic or critical goods.

He explained that the country needed a more transparent and comprehensive tax system, in addition to serving as a more consistent source of income because it was also a more effective taxation system in helping the government make calculations and projections from income tax revenue.

"It is time for us to think objectively with clear goals and seriously consider the re-implementation of GST.

"Insyaallah, with the past experiences and the mechanism that is available, we would be able to implement a more effective GST," he said.

Download Sinar Daily application.Click Here!