Use savings to invest in trust funds, not bank loans, says analyst

NURFARDLINA IZZATI MOKTAR NUR IFTITAH ROZLAN11 Jan 2023 01:22pm

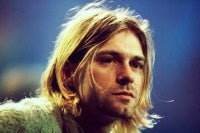

Sabah Universiti Teknologi Mara political economy senior lecturer Dr Firdausi Suffian says investors should have their own money to invest. - Bernama pic.

Sabah Universiti Teknologi Mara political economy senior lecturer Dr Firdausi Suffian said investors should have their own money to invest.

“The main objective of a trust fund is to encourage individuals to use their own money. It does not matter if the investment is RM100 or RM200 a month.

“However, the rising cost of living along with several commitments such as monthly payments of cars, houses and personal loans is causing people not to have additional money to invest in trust funds.

“The banks would offer special packages to those who want to invest in trust funds through financing, enticing individuals to take up loans,” he said to Sinar.

He said the income distribution through trust shares were much lower following the Covid-19 crisis and it was difficult to give high yields as the pre-pandemic years.

“Many need to consider whether they want to make a loan or financing especially those with the constraints to pay back the loans following the dividends that were not sufficient in paying back the loans.

“If possible don’t make any commitments to take up loans. Don’t go into debt, instead try to use savings to invest,” he said.

He predicted the dividends of trust shares in 2023 will rise compared to the previous year however, the increase would be minimal around 4.8 to five per cent.

Download Sinar Daily application.Click Here!