Duit raya dilemma: How much to give in 2025? Here’s 5 tips to consider

For some, giving duit raya is an act of generosity and tradition. For others, it is a financial strain, especially when factoring in extended family, younger cousins and friends’ children.

EACH year, as Hari Raya approaches, many Malaysians face the same question: How much duit raya should I give? With inflation rising steadily over the years, the purchasing power of the ringgit has changed significantly.

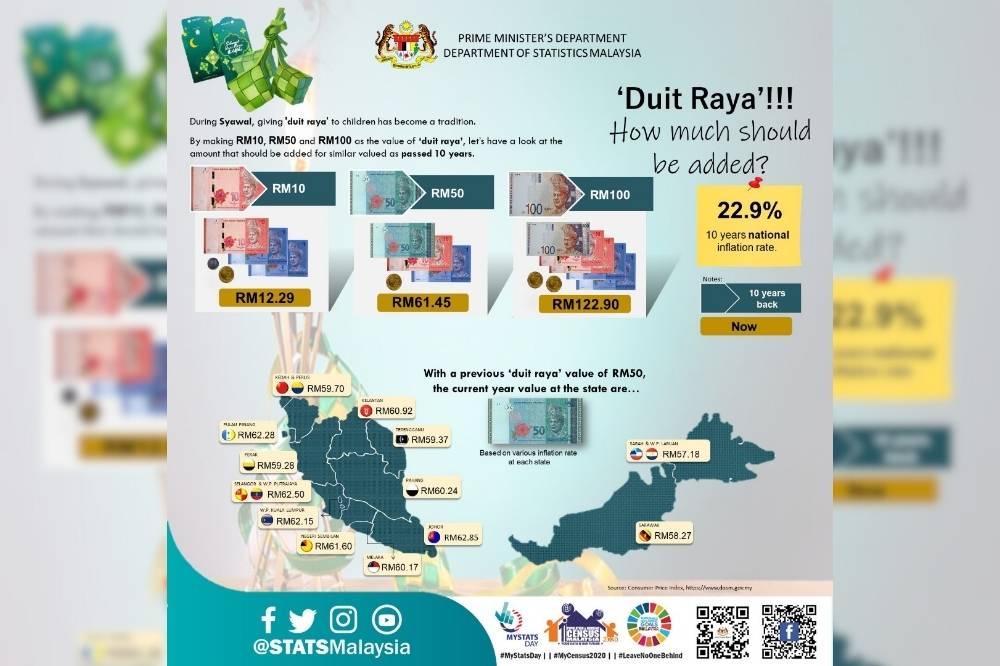

A Statistics Malaysia Department (DOSM) infographic from 2021 revealed that RM10 in 2011 was equivalent to RM12.29 in 2021 due to a 22.9 per cent inflation rate over the decade.

By 2025, the value of money has likely shifted even further, leaving many wondering if their customary duit raya contributions still hold the same meaning.

For some, giving duit raya is an act of generosity and tradition. For others, it is a financial strain, especially when factoring in extended family, younger cousins and friends’ children.

While Islam encourages charity and promises that giving will be rewarded, personal financial limitations cannot be ignored.

Should one prioritise close family members with larger sums and offer smaller amounts to others? Or is there a way to balance tradition with financial responsibility? Here are five tips for you to consider this Aidilfitri:

1. GIVE WITHIN YOUR MEANS

Financial expert and creator of Ringgit Oh Ringgit Suraya Zainudin believes duit raya contributions should never be dictated by economic trends but by the giver’s own financial situation.

“Duit raya contributions do not need to reflect current economic conditions but should instead be based on the giver’s financial capabilities. The amount given will always vary from person to person and family to family.

“Some people give as little as a few ringgit, while others give thousands—it all depends on individual circumstances,” she told Sinar Daily.

A practical way to manage duit raya spending is to categorise recipients. Suraya suggested that a useful approach is to make a list of recipients and categorise them into ‘Must Give’ and ‘Nice to Give.’

Once you determine your total budget for duit raya, you can divide the amount accordingly.

2. PRIORITISING THE RIGHT PEOPLE

For Suraya, giving thoughtfully matters more than giving lavishly. Her personal rule of thumb is to prioritise close family members, those who have contributed significantly to the Eid celebrations—such as cooking and preparing meals—and if the budget allows, relatives who have had a difficult year financially or otherwise.

She also acknowledged the joy that duit raya brings to young children.

“Some may also want to set aside small amounts (RM1–3) for younger children, just to let them experience the joy of receiving duit raya. However, there is no obligation to give beyond what you can afford.”

“Guilt and societal pressure are natural emotions, but ultimately, your financial well-being comes first. You know your own finances best and you should never jeopardise your financial future over what is, at the end of the day, just a festive tradition,” she said.

If someone gets too nosy about your duit raya budget, Suraya suggests keeping it simple. A lighthearted response like, “No more budget this year, InsyaAllah next year,” is enough to handle curious relatives.

She joked that if someone reacts poorly, you might even consider placing them on a permanent ‘no duit raya’ list.

3. BALANCING TRADITION AND MODERATION

Societal expectations can be overwhelming, but Suraya emphasised that financial decisions should always be made in the best interest of oneself and one’s family.

“Societal expectations will always exist, but that does not mean you have to follow them if they are harmful to you. Do what is best for you and your family.

“The most practical approach is to practice moderation in all aspects of Eid. It would seem unreasonable, for instance, to splurge on a new car but then claim there is no money for duit raya,” she added.

For those who receive unexpected bonuses or extra income, there is an opportunity to be more generous.

“If you receive any unexpected financial windfall, such as a tax refund or a Eid bonus from your company, consider setting aside a portion for duit raya or other Eid-related expenses,” she said.

4. GIVING BEYOND MONEY

For those who may not be able to give duit raya prefer alternative ways to embrace the spirit of giving, Suraya emphasised that generosity is not limited to money.

“For those who may not be able to give duit raya or prefer alternative ways to embrace the spirit of giving, non-monetary contributions are just as meaningful.

Helping with Raya preparations, assisting in cooking or organising fun activities—especially for the little ones—are great ways to give back and spread joy during Syawal,” she said.

5. TEACHING DUIT RAYA ETIQUETTE

While duit raya is a highlight for children, Suraya believes that it is also a moment to teach gratitude.

“While we are on the topic, parents should take the opportunity to teach their children proper duit raya manners. Kids should be reminded to say thank you and never complain about the amount they receive. In today’s economy, they are fortunate to receive anything at all.

“And if a child reacts poorly? Personally, I would hesitate to give again to a child who was ungrateful,” she said.

At the end of the day, duit raya is a cherished tradition, but it should never come at the expense of one’s financial security. Whether you give RM1 or RM100, what matters most is that it comes from a sincere heart.

Download Sinar Daily application.Click Here!