China’s EV boom outpaces Malaysian competitors

This trend was further proven as two Chinese brands, BYD and Chery recorded outstanding performances in the first four months of 2025.

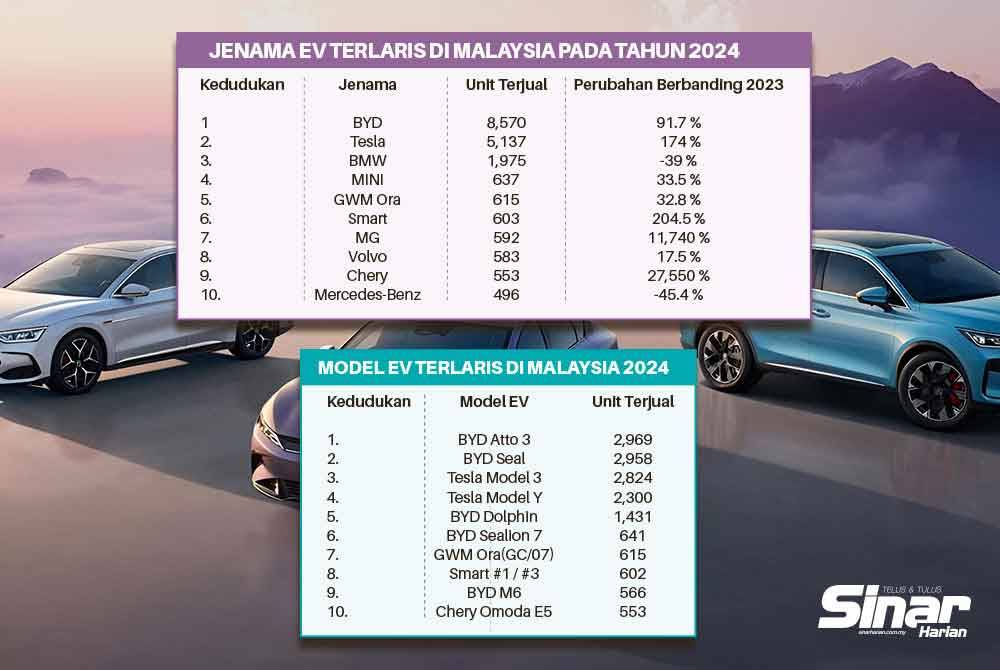

SHAH ALAM - The massive influx of Chinese automotive brands into the local electric vehicle (EV) market has created intense competition for local carmakers and several renowned global brands.

These prominent Chinese brands, offering advanced technologies at competitive prices, have changed the perception of their products from being cheaply-made to highly capable, posing a significant threat to the competitiveness of other brands.

This trend was further proven as two Chinese brands – BYD and Chery – recorded outstanding performances in the first four months of 2025, giving them an edge in the increasingly challenging market.

According to recent data, BYD recorded an astonishing 40.5 per cent year-on-year increase in sales, while Chery posted a 14.1 per cent growth over the same period.

Overall, BYD sold 3,602 units from January to April this year compared to 2,563 units during the same period in 2024.

Meanwhile, Chery recorded sales of 6,583 units so far this year, compared to 5,772 units a year ago.

Automotive industry executive engineer Farhah Kamarudin highlighted the fact that local manufacturers and other brands must compete to ensure their businesses continued to grow in light of shifting market standards due to China’s advanced EV technology.

"The growth of Chinese brands brings cutting-edge EV technologies such as battery management systems, modular EV platforms and artificial intelligence integration — all of which are still unavailable locally," she said.

As a result, she said consumers now expect smart features, long driving ranges and affordable pricing, putting pressure on original equipment manufacturers (OEMs) to catch up with equivalent technical specifications.

Farhah added that if local manufacturers failed to keep pace with developments in EV technology, they risked losing business opportunities and the existing workforce may require retraining to adapt to new technologies.

"This could lead to supply chain disruptions and job losses if not addressed quickly.

"The National Automotive Policy must be reviewed to focus more on the development of local EV technology.

"This includes incentives for research and development (R&D), charging infrastructure development and support for local vendors to produce EV components," she said.

Proactive measures

In response to questions about the challenges facing local and Japanese carmakers, Farhah said both parties were now under pressure to accelerate innovation in EV technology.

She said China was a major player that not only offered fierce competition but also has the potential to help boost Malaysia’s economic opportunities.

"Therefore, the government and industry must work together to develop the local EV ecosystem, retrain the workforce to meet new technology demands and provide investment incentives for EV technology and supporting infrastructure," she added.

Farhah said Proton, as a local brand manufacturer, has taken proactive steps by introducing affordable EV models such as the e.MAS 7 and partnering with Chinese multinational automotive conglomerate Geely to gain access to the latest EV technologies.

Proton’s success, she said however, depended on its ability to adapt this technology to local market needs.

She added that increasing local content in production was also a key factor.

Meanwhile, Electrical and Electronic R&D engineer Wan Fatin Nur Amira Wan Rusli said other OEMs still faced challenges in matching the efficiency and development scale of Chinese automotive brands.

"China’s large market allows for high production volumes, which in turn reduces costs, coupled with a vast skilled workforce.

"Product development in the country is extremely fast, whereas local R&D is still struggling to keep pace," she said.

She said some assumed that China used low standards, but their designs and testing were more stringent compared to local manufacturers.

Their presence, she said also created opportunities for Malaysian R&D to speed up technology adoption through collaboration with Chinese automotive firms.

Wan Fatin emphasised that China’s dominance in the local market nonetheless offered Malaysia a chance to learn how to accelerate technology adoption in the automotive industry through local R&D centres working in partnership with Chinese carmakers.

"Their entry enables us to learn about autonomous vehicle technology, advanced driver assistance systems and AI-based systems like smart cockpits.

"The presence of Chinese brands in the Malaysian market also offers various value-for-money options with high-tech car features," she said.

Download Sinar Daily application.Click Here!