From side gigs to social media buys: How Gen Z Malaysians spend

Pragmatic yet optimistic, deeply rooted in family values but digitally fluent, this generation is shaping the future of commerce and identity.

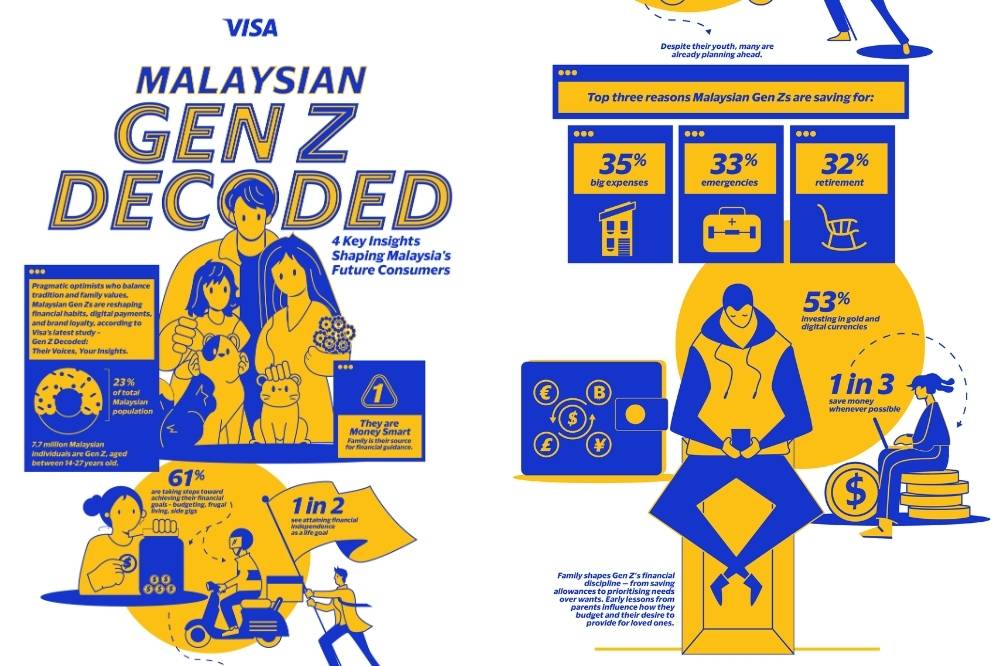

SHAH ALAM - Gen Z Malaysians, numbering about 7.7 million people or 23 per cent of the population are rewriting the rules of money, lifestyle and culture, according to Visa Malaysia’s Gen Z Decoded study.

Pragmatic yet optimistic, deeply rooted in family values but digitally fluent, this generation is shaping the future of commerce and identity.

Here are five key takeaways from the findings:

1. Financial independence comes first

Half of Malaysian Gen Zs say financial security is their top life goal. They are not just talking about it; 61 per cent are already budgeting, freelancing or taking side gigs to meet their goals.

Many are planning ahead; saving for big purchases (35 per cent), putting aside emergency funds (33 per cent) and even preparing for retirement (32 per cent). Interestingly, 53 per cent are already investing in gold and digital currencies.

2. Family is the first finance teacher

Money habits are not built in isolation. Many Gen Zs credit their parents for teaching them to save allowances, prioritise needs over wants and contribute to household needs.

These values have translated into a strong sense of shared financial responsibility, with many already helping to support their families.

3. Goodbye cash, hello digital wallets

Cash is no longer king for this generation. More than half (53 per cent) prefer digital-first payment tools such as e-wallets, debit cards and online checkout systems.

Debit cards remain the most common financial tool, but interest in credit cards is rising, with nearly one in five Gen Zs planning to apply in the coming year for rewards and cashback perks.

4. Social media shapes their spending

From TikTok (68 per cent) to YouTube (61 per cent) and Instagram (60 per cent), social platforms dominate Gen Z’s screen time. Nearly half (48 per cent) have made purchases directly from social media ads, proving how trends translate to transactions.

Trust is a big factor, with 44 per cent saying they rely on influencers and creators they follow before making a decision.

5. Passions drive purchases

Entertainment is not just fun, it is identity. 61 per cent identify as gamers and 56 per cent as music lovers, investing in in-game purchases, streaming and merchandise. For them, secure, seamless digital payments are part of the experience.

These passions also provide a sense of belonging and emotional resilience, making them more than just hobbies.

The big picture

“Gen Zs are emerging as the next wave of earners, spenders and cultural influencers. Trust, security and authenticity are central to engaging with this generation,” Visa Malaysia Country Manager Previn Pillay said.

From saving for retirement in their twenties to trusting influencers over advertisements, Gen Z Malaysians are reshaping how money and meaning intersect.

Download Sinar Daily application.Click Here!